Employing an Employee or Subcontractor

Source Reference

Australian Government - Business - https://business.gov.au/people/contractors/employee-or-contractor.

Definition of an NDIS Worker?

Under the NDIS Commission, a worker is anyone who is employed or otherwise engaged to provide NDIS support and services to people with disability. Workers can be paid or unpaid and can be people who are self-employed, employees, contractors, consultants, and volunteers.

What is an Employee?

An employee works in your business and is part of your business.

- Ability to subcontract/delegate: the worker can't subcontract/delegate the work – they can't pay someone else to do the work.

- Basis of payment – the worker is paid either:

- for the time worked

- a price per item or activity

- a commission.

- Equipment, tools, and other assets:

- your business provides all or most of the equipment, tools and other assets required to complete the work, or

- the worker provides all or most of the equipment, tools and other assets required to complete the work, but your business provides them with an allowance or reimburses them for the cost of the equipment, tools, and other assets.

- Commercial risks: the worker takes no commercial risks. Your business is legally responsible for the work done by the worker and liable for the cost of rectifying any defect in the work.

- Control over the work: your business has the right to direct the way in which the worker does their work.

- Independence: the worker is not operating independently of your business. They work within and are considered part of your business.

What is a Subcontractor?

A contractor is running their own business.

- Ability to subcontract/delegate: the worker can subcontract/delegate the work – they can pay someone else to do the work.

- Basis of payment: the worker is paid for a result achieved based on the quote they provided.

- A quote can be calculated using hourly rates or price per item to work out the total cost of the work.

- Equipment, tools, and other assets:

- the worker provides all or most of the equipment, tools and other assets required to complete the work

- the worker does not receive an allowance or reimbursement for the cost of this equipment, tools, and other assets.

- Commercial risks: the worker takes commercial risks, with the worker being legally responsible for their work and liable for the cost of rectifying any defect in their work.

- Control over the work: the worker has freedom in the way the work is done, subject to the specific terms in any contract or agreement.

- Control over the work: the worker has freedom in the way the work is done, subject to the specific terms in any contract or agreement.

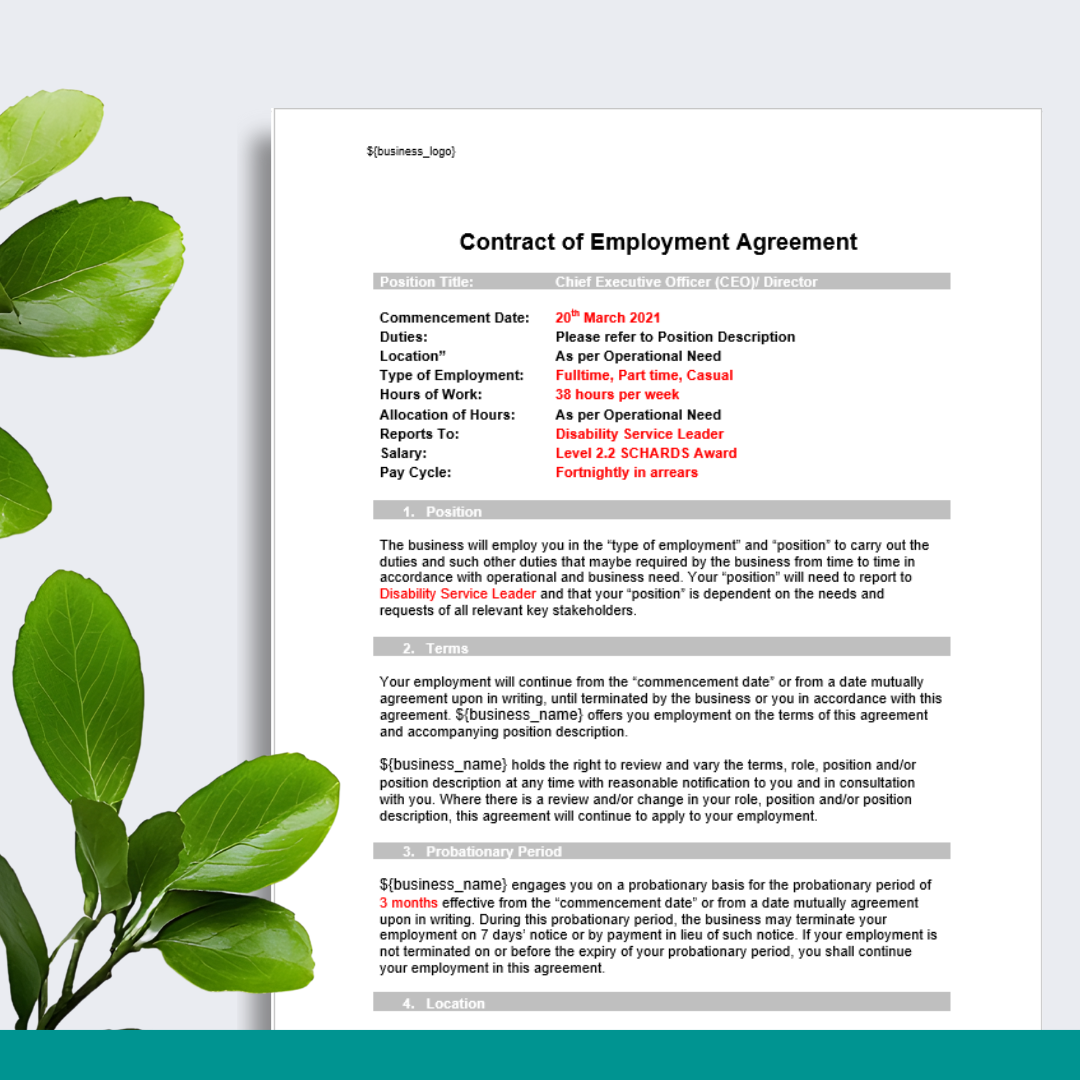

What is the SCHADS Award or an Enterprise Agreement?

The Social, Community, Home Care and Disability Services Industry Award 2020 (“SCHADS Award”) covers many employers in the social and community services sector. This includes many charities, not-for-profits and NDIS providers. The SCHADS Award consists of levels of pay rates and employment considerations such as super, staff leave that employer detail on “employee contracts”. The chosen SCHADS level to commence an employee is then compared to the NDIS Pricing Arrangement. If a company does not use the SCHADS Award, then the company can develop and submit for approval their own EA. An enterprise agreement is an agreement made at the enterprise level that contains terms and conditions of employment, including wages, for a period of up to 4 years from the date of approval. The Fair Work Act sets out requirements for bargaining for a proposed enterprise agreement.

Other Considerations of Employment

- Professional Supervision

- Knowledge of NDIS Act 2013, Human Rights, Restrictive Practices & Child Safety Principles.

- Knowledge of Customer Law & NDIS Quality & Safeguard Commission

- Implementation of relevant Policies, Procedures, Forms, Registers and Plans.

- Knowledge of GST

- Demerit Point Check

- Implementation of Marketing & Advertising

Employee/ Subcontractor Tax Obligations

Your tax, super and other obligations will vary depending on whether your worker is an employee or subcontractor.

If your worker is an employee, you'll need to:

- withhold tax (PAYG withholding) from their wages and report and pay the withheld amounts to us

- pay super, at least quarterly, for eligible employees

- report and pay fringe benefits tax (FBT) if you provide your employee with fringe benefits.

If your worker is a subcontractor:

- they generally look after their own tax obligations, so you don't have to withhold from payments to them unless they don't quote their ABN to you, or you have a voluntary agreement with them to withhold tax from their payments

- you may still have to pay super for individual contractors if the contract is principally for their labour

- you don't have FBT obligations.

Book or Speak to a DCA Consultant & Best Practice Coach TODAY!

Would you like some support to navigate the ndis, ndis commission, start-up, daily operations, legislation, compliance or service delivery implementation? Become a Member @ https://disabilitycompliance.com.au/pricing OR Book an Appointment/Training @ https://disabilitycompliance.com.au/support. Book or Speak to a DCA Consultant TODAY!

Learn More Today With DCA!

See below our guide/s to learn even more.